FIXING ILLINOIS PENSION CRISIS BY AMENDING NATION’S MOST-RESTRICTIVE PENSION LAW IS LEGAL, EFFECTIVE

By Joe Tabor, IllinoisPolicy.Org

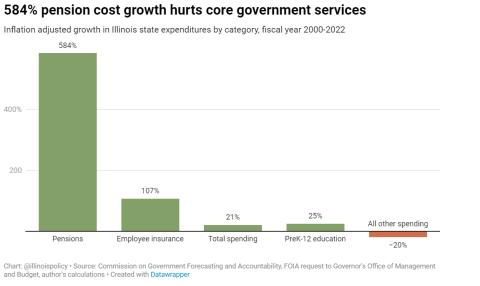

Illinois is home to one of the worst pension crises in the country. At 39% funded, according to the nonpartisan Pew Charitable Trusts, Illinois has the worst pension funding ratio of any state. By contrast, neighboring Wisconsin’s pension system is 103% funded. In fiscal year 2022, Illinois’ total general funds pension costs, including pension bond debt service, will consume $10.5 billion. That’s more than 25% of the state’s general revenues, and is just a fraction of the nearly $130 billion in total unfunded liabilities the state pension systems hold.Attempts to keep up with this unsustainable debt burden without reform have already pulled money away from higher education, public safety, public health programs, and vital services for the poor and vulnerable. Since fiscal year 2000, a 584% increase in inflation-adjusted pension spending was accompanied by a 20% cut in spending on a range of core services.Why is Illinois in this position? There is plenty of blame to go around, but former speaker of the Illinois House, Michael Madigan, now indicted on federal corruption charges, was a major player in leading the state down this path.During his tenure, Madigan voted for every major bill that would increase Illinois’ pension liabilities. In 1989, Madigan was a House sponsor for Senate Bill 95, which passed without an actuarial cost estimate. The bill was the start of 3% compounding benefit increases for retirees in Illinois’ pension systems. Unlike a true cost-of-living adjustment, these guaranteed increases are not tied to the general price level or inflation.

To add to that, critics will point to the infamous 1994 “Edgar ramp,” former Gov. Jim Edgar’s plan to backload taxpayer contributions to state pensions so they end up skyrocketing toward the end of the payment plans.7 But none of these various pieces of legislation are the source of Illinois’ pension woes. That distinction goes to the 1970 Constitutional Convention and the creation of the state’s pension clause, and the Illinois’ Supreme Court’s erroneous interpretations of that clause.

Before he was even elected to the Illinois House, voters chose Madigan as one of the delegates to the 1970 Illinois Constitutional Convention. That convention was where Illinois’ pension crisis was born. Despite warnings against passing the amendment that would handcuff future lawmakers and stymie future reform, a majority of the convention, including Michael Madigan, voted to include the provision in the new state constitution.

ILLINOIS IS AN OUTLIER CONCERNING PENSIONS

In 1970, Illinois held a convention to adopt a new constitution for the state. One of the provisions adopted was Article XIII, Section 5: the pension protection clause. That section reads:

“Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

This section of law, which may on its face seem unremarkable, has been the source of Illinois’ pension woes. Because of it, Illinois has some of the most restrictive provisions for reforming pensions in the 50 states. It is one of only eight states that enshrine public pension benefits in its constitution. And Illinois is one of only 11 states that protect future accruals for all participants. This is largely because of how the Illinois Supreme Court has interpreted the law.

The state’s courts have reliably struck down nearly all proposed reforms to Illinois’ pension system, even modest reforms that would not touch current benefits. These rulings make Illinois an outlier among other states in recent pension litigation. According to a forthcoming article by T. Leigh Anenson and Jennifer K. Gershberg in the “Notre Dame Journal of Law, Ethics, and Public Policy” that surveyed litigation challenging state pension modifications from 2014 to 2019, courts have recently been favorable to reform. The authors found a majority of pension reforms have withstood legal challenges, including in eight of 12 court decisions on cost-of-living adjustments (COLAs) in that time period.

COLAs have been one of the greatest contributing factors to Illinois’ pension crisis. Tier 1 pensioners receive an annual COLA that compounds at 3% annually, and just this annual increase makes up a large portion of the state’s liabilities. In 2013 the General Assembly passed a pension reform plan that would have addressed the problem by pegging those COLAs to inflation instead of imposing a static 3% annual increase. But this plan was struck down by the state supreme court as violating the pension clause, stating that “[a]lthough the police powers of the legislature are broad and far-reaching, our case law makes clear that their exercise must not conflict with the constitution. If the constitution mandates that something be done or not done, the legislature may not rely on its police powers to violate that mandate or override express constitutional guarantees.” This led the court to the conclusion that “the annuity reduction provisions of Public Act 98-599 enacted by the legislature and signed into law by the Governor violate article XIII, section 5’s express prohibition against the diminishment of the benefits of membership in public retirement systems.”

With that and other attempts to make local government worker pensions more fiscally sustainable forestalled by Illinois courts, the only option left is a constitutional amendment to enable the state to align public pensions with the state’s fiscal reality.

AN AMENDMENT TO THE ILLINOIS CONSTITUTION CAN ALLOW FOR NEEDED REFORMS WITHOUT RUNNING AFOUL OF THE U.S. CONSTITUTION

The Illinois Supreme Court’s interpretation of the pension clause leaves the state with one real option: a constitutional amendment. An amendment that allows the state to modify future benefits while protecting benefits that pensioners have already earned would be enough to put Illinois on a path to solvency, as the Illinois Policy Institute has demonstrated. Such an amendment to the state constitution should foreclose the possibility of a successful legal challenge under state law. But what about federal law?

Gov. J.B. Pritzker has dismissed the idea that a constitutional amendment can reform pensions, citing the Contracts Clause of the U.S. Constitution. That clause reads:

“No State shall… pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts…”

The argument is that pension benefits, including COLAs and the rate of growth in benefits, are part of an established contract the state government may not violate. This argument ignores the numerous cases where states have successfully modified contracts for a significant and legitimate public purpose, including pensions, without being barred by the federal Contracts Clause. The Contracts Clause is not an absolute bar to modifying contracts. There is a three-part test to determine if a modification such as pension reform is permitted.

First, the court must establish that a contract exists. As discussed above, Illinois courts have recognized both past and future benefits, including COLAs, as part of the state’s contract with pensioners. But federal courts, while they often defer to state interpretation in answering this question, apply federal, not state law to the analysis. That means it is possible a federal court may not even recognize future benefits, such as the COLA, as part of the contract. States cannot expand what is considered a contract by federal law simply by calling something a contract. A review of Supreme Court case law by Columbia University Law Professor Henry Paul Monaghan26 suggests “a state court cannot enlarge the range of interests embraced by the Contract[s] Clause simply by recognizing an arrangement as a ‘contract’ as a matter of state substantive law.” Another journal article by University of Minnesota Associate Professor Amy Monahan concluded rates of future accrual, as prospective changes to a contract, “should not be considered unconstitutional impairments.” However, that article as of the time of its publication in 2012 had not identified a federal case where the court ruled “in direct opposition to a state court’s finding that a contract existed under federal law.” On the contrary, there are several examples of federal courts explicitly deferring to state law on the question of what constitutes the contract. Therefore, it is still more likely a federal court will defer to the Illinois Supreme Court’s interpretation, recognizing future benefits as part of the contract being impaired under a Contracts Clause analysis.

If the court finds a contract exists, it must then find if there is a substantial impairment, i.e. that “the right abridged was one that induced the parties to contract in the first place,” or “the impaired right was one on which there had been reasonable and especial reliance.” But even if a court found the reform to be an impairment of a contractual relationship, if the policy were “reasonable and necessary to serve an important public purpose,” the reform would still be upheld. Courts will give less deference to a state’s impairment regarding what is “substantial” if the state is a party to the contract, as would be the case with Illinois public pensions.

The foundational case on public purpose principle was decided in the Great Depression in Home Building & Loan Association v. Blaisdell.34 Minnesota passed a law extending the time for mortgagers to redeem their mortgages from foreclosure. That law was challenged as an impairment of contracts, but the U.S. Supreme Court upheld the statute because the situation of the Great Depression justified the measures taken, Contracts Clause notwithstanding.

But this limitation to the Contracts Clause does not only apply in emergency situations. The Supreme Court has also given “remedying of a broad and general social or economic problem” as an example of a legitimate public purpose that can survive a Contracts Clause challenge. In that case, the issue was the modification of utilities prices in Kansas. It is certainly arguable that the pension costs that are plaguing Illinois are at least as important a public purpose.

But the actual policy must be “’clearly necessary’ or ‘essential,’ not merely convenient or expedient.” For example, the Seventh Circuit Court of Appeals has ruled removing employment protections for a teacher already tenured is not reasonable and necessary for the purpose of improving public education. If the state could achieve the goal through a less drastic modification, then the impairment will violate the Contracts Clause.

In Illinois’ case, opponents of pension reform may argue the state could always raise more taxes or cut services to fund pensions and so any modification would be unnecessary. But a decision from the Fourth Circuit Court of Appeals has also determined the fact a state could have raised taxes or could have shifted funds from other programs to fulfill their contracts is not enough for an impairment to violate the Contracts Clause. Such a requirement would mean no impairment of a government contract could ever be constitutional. Instead, the court reasoned it must only prevent states from considering “impairing the obligations of [their] own contracts on a par with other policy alternatives,” from imposing “a drastic impairment when an evident and more moderate course would serve its purposes equally well,” or from acting “unreasonably in light of the surrounding circumstances.”

Pension reform in Illinois should pass all those tests. The Illinois Policy Institute has advocated a reform that would set the state’s pension systems on track to solvency through modest changes replacing the Tier 1, 3% compounding post-retirement increases with a measure pegged to inflation and capping the maximum pensionable salary for workers hired before 2011. This reform would only apply to future benefits, and no pensioner would receive a single reduction in their benefit check. That simple modification would save the state $2 billion annually and would be much less drastic than reducing existing benefits or converting the defined benefit system to a defined contribution plan. More importantly, attempting to tax and cut services out of this situation is practically infeasible. According to calculations made in 2018 by J.P. Morgan chair of market and investment strategy Michael Cembalest, Illinois would need to spend 51% of the state budget on pensions and other post-employment benefits to eliminate the debt without reform, or raise income taxes by 25% to eliminate the debt. A 2016 Brookings Institute paper lays out the options: hope for good investment returns, raise taxes, cut spending, or increase employee contributions.

None of these options are realistically available for Illinois. Illinois pensions already use unrealistic return assumptions in their calculation and would have to achieve even larger, consistent 11.5% returns44 to close the gap. Pension funds such as the Teachers Retirement Fund are already heavily invested in alternative assets in hopes of meeting their obligations – as of 2021 TRS is over 40% invested in alternative investment assets45, which tend to carry more risk.46 Moreover, a recession like the one seen in 2008 could wipe out any of the gains pensioners are counting on.

That possibility is not mere speculation. The Illinois Policy Institute commissioned an actuarial stress test of the four largest Illinois statewide pension funds and found if funds were to lose 20% of their asset value as a result of a recession – the same loss experienced in 2009 – and the subsequent average return on investment matches the roughly 4.6% the funds experienced in the 10 years after the end of the last recession, the state’s major retirement systems would run out of money in fewer than 30 years.

Increasing taxes is unfeasible. The state already has one of the highest tax rates in the country and would have to raise income taxes at least 25% and dedicate all new revenue solely to increased pension payments. In 2018, Pritzker pushed passage of the so-called “Fair Tax” to allow the state to implement a progressive income tax, which Pritzker pitched as a solution to Illinois’ fiscal problems, including its public pension debt. The amendment to the constitution was passed by the General Assembly and submitted to the voters for approval. But those voters overwhelmingly rejected the amendment. And even if it had passed, and Pritzker’s desired tax rates were adopted, Illinois’ financial problems would not be solved. In some ways, the situation would have been worse. Economic analysis from the Illinois Policy Institute estimated the tax plan would have cost Illinois up to 95,000 jobs and $18 billion in economic activity.

Borrowing money – itself a promise of future taxes – to cover pension costs is not a realistic solution, either. Despite its recent credit upgrade, Illinois still has the worst credit rating of any state, making its borrowing costs that much greater as well. The state could pray for a federal bailout to pay for pensions, but Illinois just recently received federal funds in response to the COVID-19 pandemic and the accompanying shutdown of businesses, increased costs and predicted drop in revenues. Another influx of federal cash for the state’s self-inflicted pension woes seems unlikely.

Cutting state spending to reallocate to pensions is not a realistic option, either. Pensions already take up more than a quarter of Illinois’ budget and a greater share of its revenue than any other state. More concretely, pension payments are already crowding out essential services, and residents are feeling the pain. Cutting more to pay for pension debt would only further hinder the state’s capacity to serve the public.

The only remaining option is increasing employee contributions, and, setting aside whether the pension protection clause would permit such an increase in employee contributions, those contributions would have to skyrocket by almost 700% – typically more than 60-70% of an employee’s salary – to make up the difference. The Contracts Clause should not require the state to take such drastic measures before modifications are allowed.

In fact, pension reform has survived state contracts clause claims more often than not in recent times, as illustrated in the Anenson article. In 36 of 45 cases, pension reforms challenged under the Contracts Clause were upheld. By contrast, only 2 of 9 reforms challenged under a state’s pension clause were upheld.

Pensioners themselves should not want reform to fail, either. While the constitution prevents the state from diminishing benefits, it most likely does not require appropriations to pension funds. In fact, Illinois law makes this explicit. And if the pension systems run out of funds, then there will be no money to pay benefits and it is unlikely pensioners would have any remedy available to them.

If that happens, pensioners would simply be out of luck. But if the system is reformed to be self-sustaining, then retirees can know their retirement benefits are safe.

CONCLUSION

Pension reform is essential to fixing Illinois’ budget problems and providing basic services to its residents. Illinois’ restrictions on pension modification prevent that needed reform and make Illinois an outlier among the rest of the country when it comes to reasonable pension modification. The only real solution available to the state is to amend its constitution to allow for those needed reforms. Politicians have pointed to the federal Contracts Clause as an excuse to dismiss any such amendment, but the Contracts Clause allows for modifications that are reasonable and necessary to achieving a higher public purpose. There are plenty of reasons to believe modest pension reform will pass that test, as has been the case in states such as Rhode Island. And with the current state of Illinois’ finances, the state cannot afford not to try.