EXPERIENCED

Our knowledgeable team of professionals has years of experience handling all aspects of the appeal process, including in-depth research, data and evidence gathering, case preparation and appeal submission.

DEDICATED

We are dedicated to developing longstanding relationships with our clients and community resources. We go well beyond the basics to ensure that our clients realize an accurate and fair assessed value, while providing exceptional personalized service to each client.

PASSIONATE

At Lake County Appeal, we are passionate about ensuring that every client’s property is fairly and equitably assessed, thereby limiting their property tax liability.

Your Trusted Partner In Property Tax Reduction Since 2007

Our goal at Lake County Appeal (LCA) is for every client to be fairly and equitably assessed, thereby limiting their property tax liability.

Property taxes pose a significant cost to the home and commercial owner. We strive to lower these costs and put more money back where it belongs, in your pocket!

Our team handles all aspects of the appeal, including in-depth research, data and attorney representation.

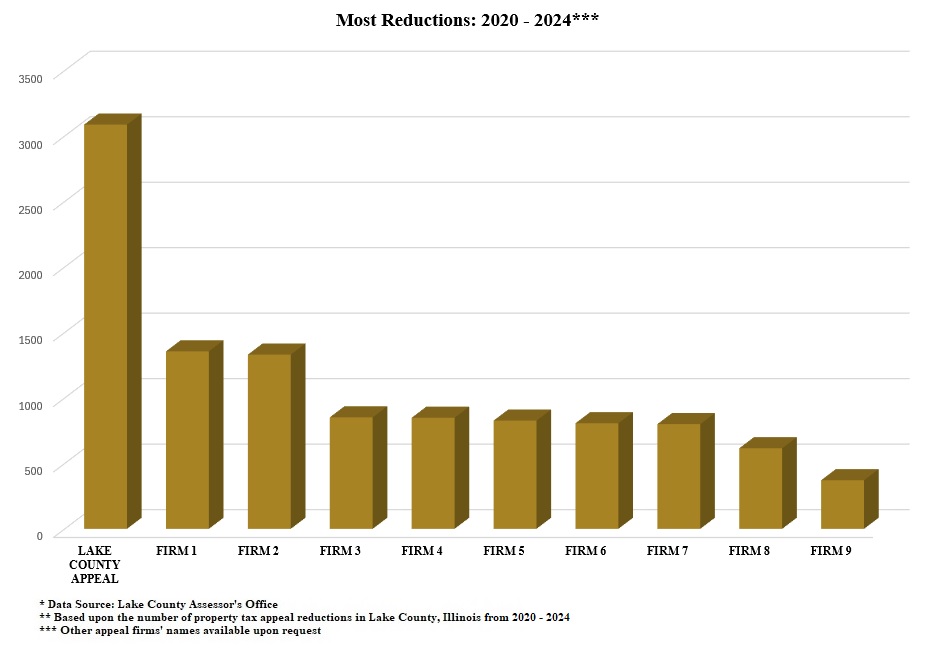

According to data from the Lake County Assessor’s office, in 2024 LCA obtained significantly more reductions than our closest competitor. This resoundingly positions us ahead of all other property tax appeal firms in Lake County.

Why Choose LCA to Reduce Your Property Taxes?

1

Experience

At Lake County Appeal, we possess the knowledge capital to win even the most challenging appeals. Our tax appeal firm comprises local experienced real estate analysts, brokers, and legal advisors, all of whom utilize a plethora of resources, including a proprietary database.

2

Community

Our team knows Lake County and Chicagoland as a whole. Over the years, we have developed deep-rooted experience that spans neighborhoods, schools, and townships. Combined with our strong relationships with county representatives and decision makers, it positions us ahead of the curve.

3

Established

LCA has helped homeowners and commercial property owners since 2007. Yearly, we obtain significantly more reductions than our closest competitor. This resoundingly positions us ahead of all other property tax appeal firms operating in Lake County, IL.

Client Satisfaction

Accepted Cases

Tax Savings Satisfaction

LCA has helped homeowners and commercial property owners since 2007. Yearly, according to the Lake County Board of Review, we obtain significantly more reductions than our closest competitor. This resoundingly positions us ahead of all other property tax appeal firms operating in Lake County, IL.

At Lake County Appeal, we possess the knowledge capital to obtain reductions for the most challenging appeals. Our tax appeal firm comprises local experienced real estate analysts, brokers, and legal advisors, all of whom utilize a plethora of resources, including a proprietary database.

Our team knows Lake County and Chicagoland as a whole. Over the years, we have developed deep-rooted experience that spans neighborhoods, schools, and townships. Combined with our strong relationships with county representatives and decision makers, it positions us ahead of the curve.obtains significantly more reductions than our closest competitor.

All property owners!

Everyone should have an advocate on their side to ensure they are being properly assessed and taxed by the county assessor’s office.

The process to lower property taxes is to file an appeal with the county board review. This is typically done by reviewing the county’s valuation of your property and comparing that valuation to similar recently-sold properties. If the recently-sold properties sold for less than the county’s valuation of your property, Lake County Appeal will file the appeal.

There are instances when a property owner can file his or her own appeal. If considering this option, we highly recommend you read the most current rules of the county board of review to understand your rights and the process.

However, by hiring Lake County Appeal, the possibility of a successful appeal is significantly greater. Our proprietary database, experience, access to data, and relationships across the area make LCA the better choice. As an analogy, do you service your car or furnace twice a year? If not, why wouldn’t you also leave your property tax liability in the hands of qualified professionals?

ake County Appeal is the largest and most successful property tax appeal firm in Lake County, Illinois! According to data from the Lake County Assessor’s office, over the past five years, LCA has obtained significantly more reductions than our closest competitor. This resoundingly positions us ahead of all other property tax appeal firms in Lake County.

1. Click the Sign-Up button and create an account with your contact and billing information. Returning clients should Log in with their username and password;

2. Once the account has been verified and a password set, click the Property Search button and enter the ten-digit parcel number for your property (PIN), select your county and click on Submit

3. Click your cursor on the property address (a blue link), answer the questions and click add to cart; and Delete this and change to Answer the questions and then click on Save;

4. Click on PLEASE CLICK HERE TO CHECK OUT or on your Shopping Cart and then click on Check Out;

5. Enter all requested credit card information and then click on Continue to Sign Contract;

6. Read the contract, and put a checkmark in the box to the left of "I hereby agree to the above terms and conditions".;

7. Type your name in the rectangular Contract Signature box; and

8. Click on Pay and complete purchase…You will be given an order number and will also know that you've successfully completed the signup process when you receive an e-mail back from us containing a copy of the online contract that you just signed. You will receive it instantaneously at the time of completion.

For more information on our sign-up process, please refer to our video on our Sign-Up page.

The first step in the property tax appeal process is the assessment review.

During an assessment review, our team of Realtors and real estate analysts determine the correct property value by using the LCA proprietary database and their years of experience in the marketplace.

The next step is to have an attorney then review the documentation and determine if an appeal is warranted. If so, we file your appeal and complete all administration,

documentation, hearings, and communication with the county. Whether LCA determines there is evidence for appeal or not, the information is shared with our client.

For more information on the assessment appeal process, visit our Assessment Appeal page.

To review our fee structure, please visit our Lake County Appeal Fees page.

Our fee structure is two parts…

- A $65 upfront fee per property to conduct a property assessment review.

- A contingent fee of 37.5 % of the first year’s tax savings.

Our team works together using our proprietary software to determine whether your property is fairly assessed.

If we find the property valuation to be unfair, we file the appeal at no additional cost. If the appeal is successful, we will collect 37.5% of the first year’s tax savings, while you retain the remaining 62.5%, as well as 100% of any subsequent years’ tax savings. (Note that tax savings end when the quadrennial assessment period ends.)

* We determine your tax savings by taking your original assessment and subtracting your lowered assessment and multiplying the difference by the tax rate set forth on your property tax bill.

We determine your tax savings by taking your original assessment, then subtracting your lowered assessment and multiplying the difference by the tax rate set forth on your property tax bill.

You will receive the result of your assessment review about five days prior to the appeal deadline for your township. The deadline varies every year. Our communications are by email, so be sure our emails are going into your inbox and not to your spam folder.